FintechZoom Costco Stock: Investing in stocks often involves predicting the future. This task is a challenge and full of uncertainties. But, with proper analysis equipment and knowledge of the market, forecasts can provide invaluable information to traders who want to make informed decisions. In the case of those who are considering investment in the Fintechzoom Costco stock, an enthralling prediction for 2024 is available from the trusted financial platform Fintechzoom. This comprehensive forecast dives deep into various aspects of the business as well as market tendencies, to map its growth trajectory over the next few years.

This extensive exploration of Costco’s inventory forecast for 2024 provides a broad overview of the company’s position in the marketplace as well as its strategies and the wider market landscape that will affect its performance overall. Fintechzoom’s strategy will be covered, and the optimistic forecasts of Costco’s inventory, the potential issues that are coming up, as well as others. If you’re an investor in the making, a financial expert, or a professional, the purpose of this review is to focus on providing readers with the data-driven story you require to comprehend Costco’s future.

INTRODUCTION

Costco Wholesale Corporation stands as an undisputed retail giant and an essential part of the shopping experience for customers. The company’s model of business, which is based on memberships and bulk sales and bulk sales, has built a loyal client base as well as an incredible financial influence. The truth is that knowing Costco’s share forecast doesn’t necessarily reflect the force behind its customer enthusiasm; it’s about delving into the intricate web of economic forces and organizational dynamics that determine its value.

The process of navigating the stock market is similar to sailing through an avalanche. Although some investors have a weather eye that has been honed over many years of experience, others use sophisticated tools and records of meteorological conditions to determine their course. Fintechzoom is a perfect example of the former, combining analytical rigor and technology to provide forecasts to traders to steer them toward safer and more profitable water.

HISTORICAL PERFORMANCE OF FINTECHZOOM COSTCO STOCK

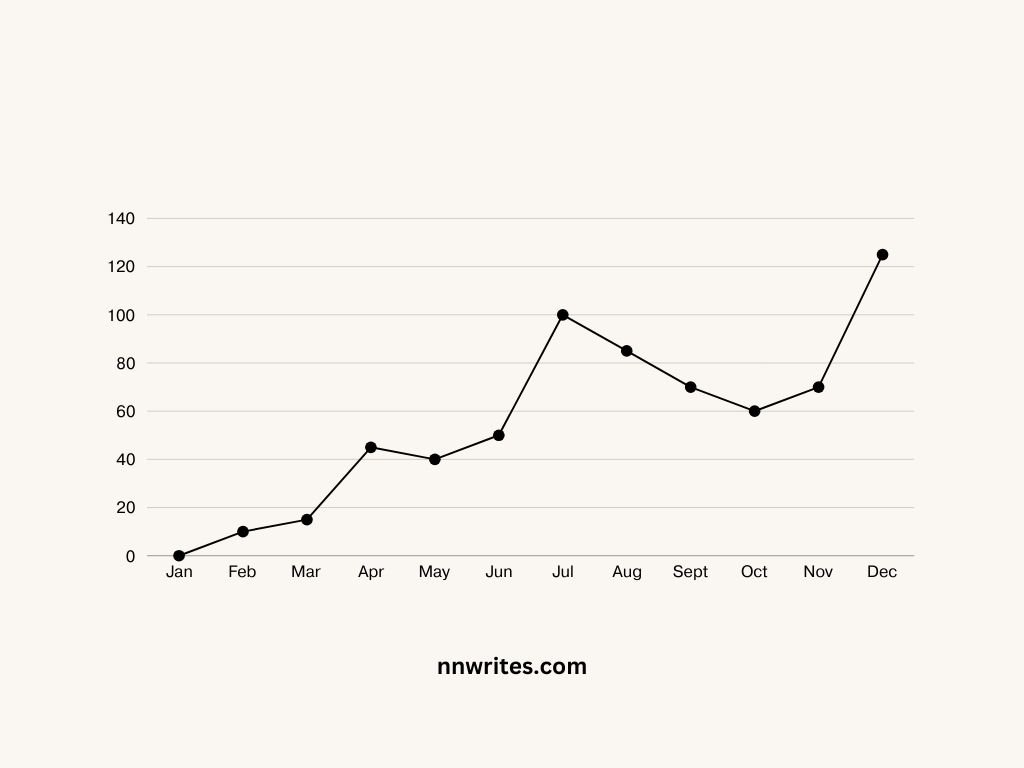

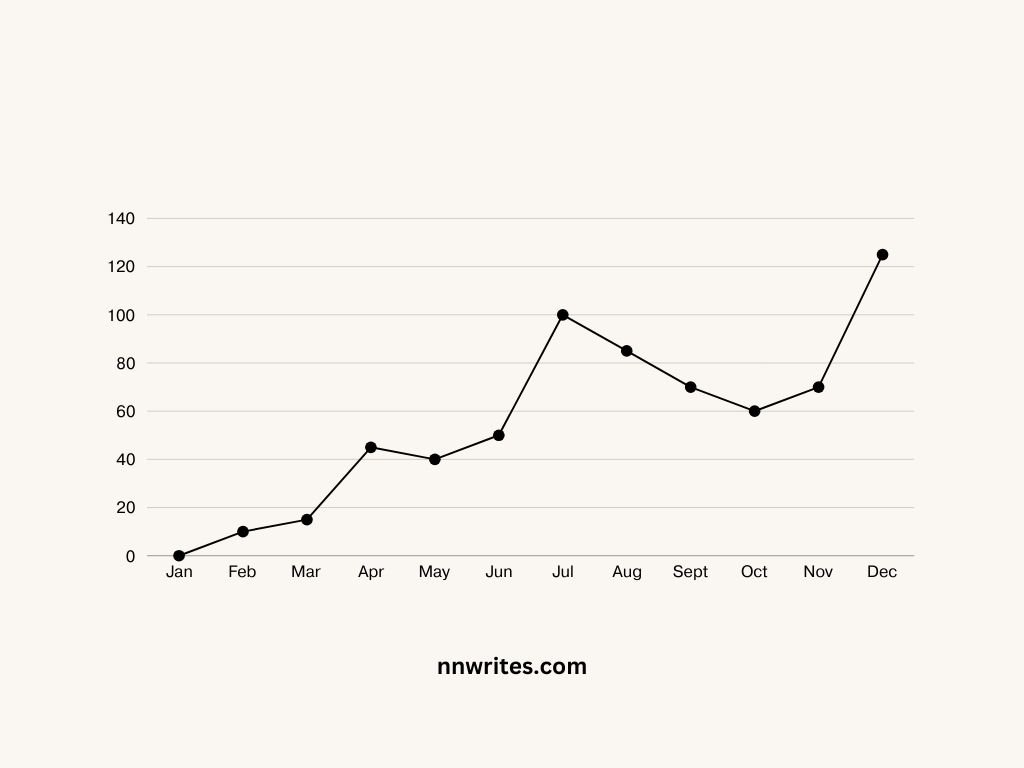

To understand Costco’s future, we must first assess the storms it faces. In the past decade, Costco’s inventory closely mirrored its operational successes as well as the turbulence of its circumstances. The factors that result from transforming customer behavior, economic downturns, and advancements in technology are all having an impact on the company’s share price.

The stock’s performance of Costco’s past is buoyed by the prospect of a robust revenue improvement as well as profitability. The company’s constant music report and customer loyalty have been a key factor in the company’s rise. The most notable landmarks of Costco’s history include strategies for expanding its competitive edge, which range from the launch of new warehouses to international expansions that are powerful catalysts for improving inventory.

Read More: FINTECHZOOM IBM STOCK INVESTMENT GUIDE: SUCCESS TIPS FOR 2024

Critical inflection points of the overall performance of its inventory resulted from the development of new offerings such as expedited grocery delivery and technological innovations in stores, as well as investments in the employee base and corporate duty programs. Each of these initiatives has had a different effect on market reception as well as the general performance of the stock.

METHODOLOGY BEHIND FINTECHZOOM’S FORECAST

Costco’s fintech zoom stock is not a forecast of a crystal ball; it’s a careful evaluation with a keen eye on a variety of factors. Their approach is simple and systematic, relying on the combination of fundamental as well as technical analysis to create an accurate image of the future performance of Costco. The method involves assessing Costco’s alignment with strategic company choices to the opportunities and challenges of the market.

Fintechzoom analysts comb through a variety of industry records, financial data patterns, and other historical indicators to identify the most innovative and original interpretative ideas. It’s the combination of all this data that differentiates the fintech Zoom Costco stocks, which harmonizes different information to provide a unifying and captivating story for investors.

Read More: FTSE 100 FintechZoom Analysis Top Insights

BULLISH PREDICTIONS FOR FINTECHZOOM COSTCO STOCK IN 2024

Fintechzoom expects a bullish trend for the Costco stock price in 2024. This will propel it to large profit. The optimism stems from several robust indicators and the tactical strategies that they are confident Costco can execute energetically.

Revenue Growth

One of the most exciting opportunities for Costco’s future is enormous revenue growth. The forecast by Fintechzoom predicts that with a steady inflation rate and robust customer spending Costco is likely to benefit from the improvement in the number of customers calling. Additionally, the introduction of advanced pricing analytics, as well as strategically targeted promotions, are expected to increase customer loyalties and generate incremental revenue.

Earnings Per Share (EPS) Projections

Fintechzoom’s optimistic forecast extends to Costco’s anticipated income per share for 2024. The company is expected to show impressive achievement in this field with a strong emphasis on managing prices and operating efficiency. This methodical approach, when paired with an impressive top-line expansion, will boost Costco’s stock price and confidence in investors.

Market Share Expansion

One of the most appealing aspects of Fintechzoom is Costco’s stock forecast market percentage increase. Costco’s efforts to expand its online presence together with the success of its traditional brick-and-mortar company is likely to result in a better marketplace function. Costco’s “individuals-first” strategy and its unique pricing strategy are expected to appeal to an even larger number of customers and will allow for significant market growth.

Read More: OFFICIAL WEBSITE FINTECHZOOM.COM: A COMPLETE Real REVIEW 2024

E-Trade And Digital Initiatives

Costco’s determination to evolve its digital environment is mentioned, and Fintechzoom Costco stock anticipates a robust performance for its efforts in e-commerce in the coming months. There is a significant increase in sales online due to improved logistics, increased product selection, and the rapid implementation of digital systems for improved customer satisfaction as well as accessibility.

POTENTIAL RISKS AND CHALLENGES

A forecast can never be complete without the ability to identify risks. Fintechzoom’s analysis doesn’t shield us from the winds that will affect Costco’s inventory prices for 2024. Financial uncertainties, regulatory changes, as well as competitive pressures, are looming as dark clouds within the otherwise bright outlook. The volatility of inflation and uncertainty of global supply chains present serious risks to Costco’s profitability and sales projections. Additionally, changes in consumer behaviours and preferences can be disruptive, requiring quick strategic adjustments in retail.

Also Read: Can How I Make 200 Dollars Daily

INDUSTRY TRENDS IMPACTING COSTCO’S STOCK

Costco’s wholesale and retail business is a tapestry made of unsteady threads. 2024 will bring fresh shades to the spectrum. With the increasing digitization of purchase studies and the increased emphasis on sustainability, these trends will eventually fade the mark they leave on Costco’s stock. Fintechzoom’s projections for these changes, incorporating these into its analysis to add complete information on Costco’s inventory’s outcome in 2024.

GLOBAL EXPANSION AND INTERNATIONAL MARKETS

Costco’s global footprint is set to expand further and Fintechzoom anticipates an incredibly successful global venture. The areas of interest include Europe as well as Asia as well, and Costco has the potential to profit from a growing middle-class population growth as well as favorable financial conditions. The commitment to a global boom is an educated guess, a testimony of Costco’s strategic plan and Fintechzoom’s faith that it will be successful in executing its plan.

CONSUMER BEHAVIOR AND SPENDING PATTERNS

The current state of consumer behavior is painted by wide strokes of change as well and Costco is set to grow well in its forecast. The rise in “aware consumerism is likely to result in the demand for more sustainable products as well as ethical business policies. Fintechzoom Costco Stock will rise as a result of this initiative and will improve the quality of its products and operating methods to attract the growing population.

Read More: FINTECHZOOM F STOCK: Unveiling the Future of the 2024 Market (Ford’s Stock)

SUPPLY CHAIN AND LOGISTICS EFFICIENCY

The links of Costco’s supply chain are intertwined and 2024 will be marked with a focus on green logistics and agility. Fintechzoom Costco Stock will put cash into technological advancements as well as strategic alliances that will strengthen the supply chain to withstand disruptions and inefficiencies. The robust and flexible logistics infrastructure is predicted to boost Costco’s inventory management, giving the company a significant advantage in competition.

TECHNOLOGY AND INNOVATION INVESTMENTS

Costco’s dedication to technological advancement and strategic investments through 2024 is expected to bring huge dividends. Fintechzoom Costco Stock will continue to implement and create modern strategies to enhance the customer experience and increase operational efficiency. They include sophisticated facts analytics, AI-driven insights for customers, innovative strategies to boost sustainability, and ESG integration.

REGULATORY AND COMPLIANCE CONSIDERATIONS

In Costco’s tapestry from 2024 are the regulations warp and compliance weft. Fintechzoom’s analysis examines the possible impact of changing guidelines on Costco’s operations and its cost. Particularly, regulations about environmental protection as well as tax reforms are identified as areas that require scrutiny. Costco’s proactive approach to compliance will likely ease this issue by working by the minimal impact guidelines.

Read More: Unlocking 2024 Potential: FintechZoom GE Stock Insights

SOCIAL RESPONSIBILITY AND ESG FACTORS

The landscape of the 2024 market could have sunshades of social responsibility as well as ESG components. Fintechzoom’s projection highlights the increasing importance of these topics in the world of investment. Costco’s strong social obligation structure and commitment to ESG integration are seen as factors that can boost stock performance, appeal to a larger market, and improve the stock options for long-term investors.

INVESTOR SENTIMENT AND MARKET PERCEPTION

It is an unpredictable partner, susceptible to fluctuations and altered by circumstances. Fintechzoom’s outlook to 2024 weighs the possible shifts in the investor’s sentiment as well as the perception of consumers toward Costco. An optimistic view, supported by consistently high performance and strategic thinking can be expected to bring an impact on Costco’s stock outperformance. On the other hand, any bad behavior or blunders could cause temporary declines in the self-assurance of investors as well as charges for inventory.

LONG-TERM GROWTH PROSPECTS AND STRATEGIC VISION

Fintechzoom Costco Stock forecast is an amalgamation of long-term improvement opportunities and strategies that are imaginative and forward-looking. Costco’s resilient business model, with a commitment to its values at the core, as well as a flexible operational model, can result from an extended period of steady expansion. The outlook aligns Costco with Fintechzoom’s optimistic projection, making it an attractive investment opportunity for people with a long-term view.

EXPERT OPINIONS AND THIRD-PARTY VALIDATION

Finally, well-qualified critiques and third-party verifications combine to form the foundation of the Fintechzoom Costco Stock forecast. These perspectives complement and confirm Fintechzoom’s research adding credibility and depth to the story it tells. Through capturing and integrating the thoughts of thought leaders as well as experts from the enterprise this forecast gets rich in nuance and has an impact on the larger investing group.

This is not a static representation of the future, but an evolving illustration that is open to revision and change if new information is discovered. For buyers and stakeholders alike, it offers a hard and fast of binoculars–permitting a glimpse, albeit a knowledgeable and speculative one, of one capacity future. Though this outlook is insightful, however, it is crucial to use it as a starting point for considering investment options and not as the main celebrity to guide all decisions regarding investments.

The process of navigating the market for inventory, as with the seas requires a mix of knowledge, skill, and an element of risk. The Fintechzoom forecast can serve as an indication of direction or background to your journey into investing be aware that investing over time is a one-of-a-kind business. Similar to Costco, traders must make their own choices, parsing the waves of risk and data and charting their exact course.

Read More: Fintechzoom Apple Stock analysis: unlocking Insights

ADDITIONAL RESOURCES

- Detailed Report on Fintechzoom Costco Stock Forecast

- Get an in-depth look at Fintechzoom’s full analysis of Costco’s prospects in the market for inventory. We’ll explore aspects of strategic importance such as market dynamics, as well as financing possibilities.

- The collection provides essential perspectives and analysis, offering valuable details for anyone looking to understand the retail industry’s dynamic that is based on Costco’s position and strategy in the marketplace.

FREQUENTLY ASKED QUESTIONS (FAQ)

How Does Fintechzoom’s Forecasting Method Painting?

- This method combines quantitative assessment as well as enterprise trends analysis as well as expert assessments. It is comprised of machine learning algorithms as well as fact analytics that anticipate market movements and inventory performance.

What Elements Are Taken Into Consideration In Fintechzoom Costco Stock 2024?

- Important elements include market trends and customer behaviour, global financial conditions, technological advances, and regulatory changes. the financial stability of Costco and its strategically planned projects.

How Does Costco’s Forecasted Performance Evaluate Its Industry Friends?

- Fintechzoom Costco Stock shows that Costco is in the right place for continued expansion. It is surpassing many of its peers due to its solid base of operations and flexible business strategy.

Should I Solely Rely Upon Fintechzoom’s Forecast While Making Funding Decisions?

- Even though Fintechzoom provides valuable insights trader must consider several sources and perform their complete due diligence.

What Is The Historical Performance Of Costco’s Stock?

- Costco’s inventory is known for its durability and increase and has a solid track record of stability as well as return on investment. This makes Costco an unbeatable competitor in the retail sector.

How Does Costco’s E-Trade Method Affect Its Inventory Forecast?

- Costco’s e-trade strategy can positively affect its forecast for stock prices by taking advantage of the growing internet-based retail market and adjusting to change buyer buying patterns.

What Function Does Global Enlargement Play In Costco’s 2024 Inventory Forecast?

Global expansion is an important driver in the forecast, and it could boost Costco’s market share and revenues by expanding into new markets and taking advantage of international opportunities for boom.

How Are Consumer Behavior And Spending Patterns Influencing Costco’s Stock Outlook?

Changes to a value-based approach to spending buying online, as well as a selection of sustainable products, are major trends that affect Costco’s excellent inventory outlook in line with the company’s business practices.

What economic metrics does FintechZoom employ to forecast Costco’s inventory performance?

Important metrics include the growth in revenue, income margins operating performance, and the return on equity, along with other measures, which are used to evaluate the health of an organization’s economy and to predict its general inventory performance.

Analyzing the Impact of Compliance with Regulations on Costco’s Stock Forecast

The impact of regulatory compliance on the projection is likely to increase costs or even limit the operation; however, Costco’s proactive approach could be to reduce adverse outcomes.

Insights: Fintechzoom’s 2024 Outlook on Costco’s Dividend Yield

Fintechzoom Costco Stock dividend yield is positive and is expected to grow in the future, with possibly accelerated dividends based on the firm’s financial stability and commitment to return dividends to shareholders.

How does Costco’s inventory forecast depend on how well its supply chain and logistics work?

Logistics and supply chain performance is crucial for Costco’s projections providing a competitive advantage by guaranteeing availability of goods along with fee management and customer satisfaction.

What are the chances that Fintechzoom Costco Stock will be able to grow in 2024?

Opportunities are in expanding into new markets, improving e-commerce operations, and exploring the latest product trends as well as services with the market percentage and sales growth.

How does Costco’s position in the market affect its inventory forecast?

Costco’s strong and aggressive position, built on its membership program, low-cost strategy, and high level of customer loyalty, helps to create a solid inventory forecast and separates Costco from competitors.

How does Fintechzoom rate Costco’s investments in new technology and generation?

Fintechzoom Costco Stock views these investments as crucial enablers to shortly rise as well as efficiency gains, certainly affecting the forecast for inventory through improved operation and consumer information.

What happens to Fintechzoom Costco stock when environmental, social, and governance (ESG) factors are taken into account?

ESG components enhance Costco’s forecast because they are in line with investors’ expectations of sustainable and ethical company practices. It is certain to attract investments and create lengthy growth.

Where can I check out Fintechzoom’s full report on Costco’s inventory forecast for 2024?

Fintechzoom Costco Stock’s full report is on its site with a comprehensive evaluation as well as insight into Costco’s inventory forecasts in 2024 and beyond.

If you want to know about themes and plugins then you can click on it: Click Now