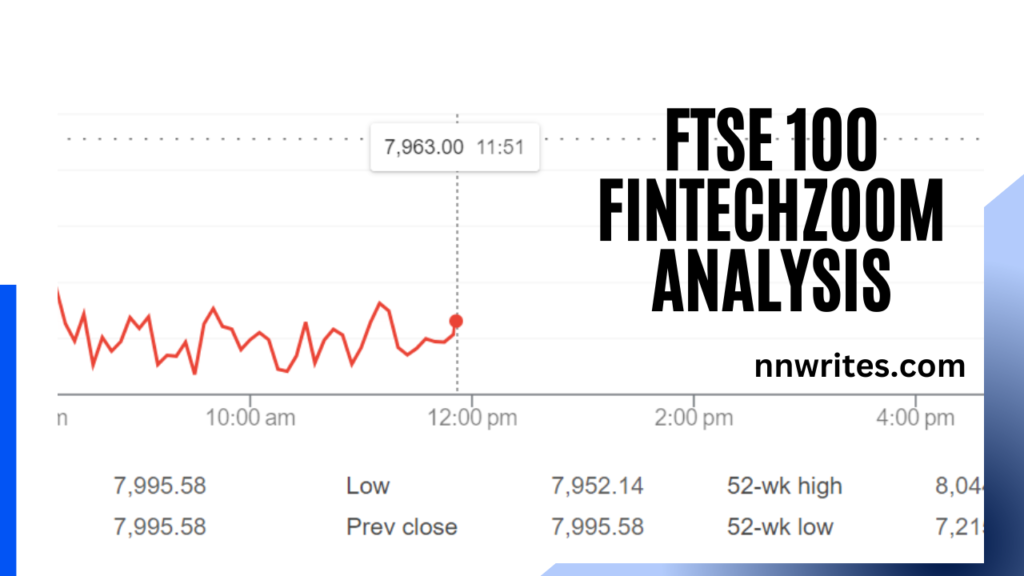

FTSE 100 FintechZoom: The FTSE 100 has long been a sign of the health of the world economy and a sign of how the business and economic markets are doing. However, generational change is still shaking up the financial world, and now fintech is having a new wave of effects on the FTSE 100. This blog post goes into detail about the exact fintech trends that are not only shaking up the business world but also making new paths in the prestigious list of the UK’s top groups.

The FTSE 100 is on the rise now.

These days, the FTSE 100 isn’t just made up of blue-chip stocks. It’s about how groundbreaking technological advances may be changing how people think about investments, banking, and managing income. Fintech is at the forefront of this change. This part of the market is very important for businesses and other important people to understand because it not only shows bigger opportunities but also huge changes in finance.

A look at the history of fintech

The word “fintech” may also seem like a new fad, but its roots are in the past of the financial industry. From the first bank-issued URL in the 1990s to the first mobile accounts and virtual banking services, fintech has grown at the same rate as traditional finance. The rate at which this change has sped up in recent years has been amazing, and now fintech is not just an add-on; it’s essential to the direction of the industry.

Read More: FINTECHZOOM IBM STOCK INVESTMENT GUIDE: SUCCESS TIPS FOR 2024

The Current State of Fintech

Fintech has grown into a huge industry now, with tech and money issues affecting almost every part of life. Here in the FTSE 100, we can see both new companies coming in and old companies changing to stay relevant. The range of businesses in the 100 companies gives a full picture of the many fintech areas that may be doing well. No part of the world economy has been left out of the fintech change, from big data analytics to green and sustainable finance.

THE USAGE OF BLOCKCHAIN TECHNOLOGY

Blockchain is without a question one of the most revolutionary changes in the history of finance. Blockchain is famous for being the basis for cryptocurrencies, but it can do a lot more. The use of FTSE 100 FintechZoom groups to encourage adoption shows the generation’s balance and long-term value.

Blockchain’s Impact At The FTSE 100

It’s not just a list of virtual coins, blockchain is more than that. Its decentralized and safe nature makes it useful in finance for clearing and payment, exchange finance, and lowering fraud. Traders who want to back companies on the cutting edge of financial innovation need to know how blockchain works and how it can be used in the FTSE 100.

Exploring Blockchain In The FTSE A 100

A lot of companies in the FTSE 100 are looking into blockchain technology. They are doing everything from testing payment solutions to completely changing how settlements are handled. These projects show how blockchain is becoming more useful for making international and business deals more efficient, clear, and safe.

CHANGES IN DIGITAL BANKING

As customers’ needs for banking services change, virtual banking has quickly gone from being a joke to something that everyone needs to do. Virtual-only banks are becoming more popular, and virtual banking features are quickly being added to regular banks. These changes are completely changing the way people bank.

Read More: OFFICIAL WEBSITE FINTECHZOOM.COM: A COMPLETE Real REVIEW 2024

The moving of banking services online

Modern buyers want digital banking because it is easy to use and convenient. FTSE 100 FintechZoom has seen a rise in virtual transformation, with a focus on user experience. This marks the start of a new era in which brick-and-mortar banking is no longer the norm but a luxury.

How traditional banks are responding to digital need

Instead of fighting change, many FTSE 100 FintechZoom giants are leading the way in going digital. They are using online and mobile banking, changing the way they do customer service, and using data to make banking stories more personal.

Money AI and ML

The coming together of artificial intelligence, gadget mastering, and financial services is making way for amazing technological progress. This gets in the way a lot when making business plans and dealing with risk and fraud.

How Advanced Analytics Can Help You Make Money Investments

AI and machine learning-driven investment strategies are flexible and quick to change. They can sift through huge amounts of data to find investment opportunities and market trends that human experts would miss.

Evaluation of risks and detection of fraud

AI and ML can predict the future, which can also lead to more complex threat assessment strategies that can predict changes in the market and how customers will act. Of course, these technologies are also very important for finding scams and protecting financial assets.

100 fintech ftse zoom Open Banking and APIs

Banks and APIs that are open

Innovation is sped up by open banking efforts and the wide availability of APIs. They are making it easier for people to work together and offer more services, and some FTSE 100 FintechZoom companies are taking advantage of this.

Putting financial data out there

Open banking aims to encourage competition and new ideas by making it easy for people to share information continuously. Because of this order, FTSE 100 FintechZoom is changing the financial scene by encouraging a more united and customer-focused attitude.

Read More: FINTECHZOOM F STOCK: Unveiling the Future of the 2024 Market (Ford’s Stock)

FTSE 100 companies that use APIs the most

The FTSE 100 FintechZoom is using APIs to connect different services, like mobile apps and online systems. This is resulting in better customer experiences and more efficient operations.

GIFT CARDS AND MOBILE PAYMENTS

The widespread use of cell payment systems has completely changed how we handle money transfers. This trend is still going strong at the FTSE 100 FintechZoom, where more and more companies are adding virtual wallets to their provider services.

The Society Without Cash

Cell phone payments are making it faster and faster for people to live without cash. Companies in the FTSE 100 are seeing the need to make this change easier and are offering safe and user-friendly virtual charge solutions.

Adding to the FTSE 100 group

Mobile payments and digital wallets are useful in many areas, from retail to investment banking, because they make transactions easier and give businesses an edge. The FTSE 100 FintechZoom is at the front of this change, with integrations that meet the needs of a wide range of buyers.

REGTECH NEW IDEAS

Regtech, which stands for “regulatory era,” is becoming an important part of modern finance. It combines technology with rules and regulations, and FTSE 100 FintechZoom companies are using it to make their operations run more smoothly.

A New Way To Follow The Rules

Regulation technology isn’t just about following the rules; it’s also about taking proactive steps that stop capacity compliance problems before they happen.

Read More: Fintechzoom Apple Stock analysis: unlocking Insights

Implementation and Effects on the FTSE 100

The FTSE 100 is using regtech to improve reporting, find threats, fight financial crime, and keep an eye on the complex regulatory environment. Not only do these projects ensure compliance, but they also make business practices and the customer experience better.

ftse 100 fintechzoom INSURTECH ADVANCEMENTS

In the coverage area, advances in technology are making it possible for more customized and environmentally friendly goods to be made. This can be seen in the work of the FTSE 100 FintechZoom insurers in particular.

Customized insurance with the help of technology

Insurtech is all about using technology to make insurance products more personalized and easier to use. The fact that FTSE 100 FintechZoom is involved in this motion shows that the company is asking questions ahead of time.

Leading the way in insurance tech

From AI underwriting algorithms to IoT-based fully automated solutions, FTSE 100 FintechZoom companies are on the cutting edge of insurtech trends. They offer a wide range of cutting-edge products that meet policyholders’ changing needs.

Auto-advisors and investing that is done for you

Robo-advisory systems are automating the process of recommending funding, which means that it can be used by more people. The FTSE 100 FintechZoom is changing to fit this style, so it’s no longer just a market for startups.

Read More: FintechZoom NIO Stock-Unlocking Potential in Today’s Market

Making Investing More Open to Everyone

Retail traders haven’t always been able to get access to wealth management services, but robo-advisors are breaking down those barriers and offering low-value solutions that are easier to get and use.

The FTSE 100 is taking part in automated investments.

The FTSE 100 FintechZoom is home to a number of companies that have developed or invested in robo-advisory systems because they see the benefits they offer traders and fund managers in terms of lower fees and better portfolio management.

FTSE 100 fintech zoom

WHY FINTECH NEEDS CYBERSECURITY

The financial region is becoming more and more dependent on technology, which has raised the stakes in cybersecurity. It is very important to make sure that transactions are honest and that sensitive data is kept safe.

How important cybersecurity is becoming

The modern business world is always dealing with cyber threats. The way the FTSE 100 FintechZoom dealt with these problems shows how committed it is to protecting assets and keeping trust.

New ideas in cyber security solutions

It is the FTSE 100 FintechZoom companies that are coming up with and enforcing today’s cybersecurity solutions. These technologies, ranging from biometric authentication to advanced encryption, are very important for making sure that the future of fintech is safe.

Trends in decentralized finance (DEFI)

DeFi is a brand-new way of thinking about money that is open to everyone and doesn’t have any borders. Its growth can be seen in the fact that FTSE 100 FintechZoom companies are interested in looking into its possible programs.

The basics of DeFi and what it can do

DeFi isn’t just a group of specialized goods; it’s a whole new way of doing business that uses public blockchains to run without the need for traditional middlemen.

FTSE 100 Explorations In DeFi

Several FTSE 100 FintechZoom companies are looking into DeFi’s ideas and creating pilot projects to figure out how they can use its innovative and game-changing potential to their own benefit.

Read More: FintechZoom UPST Stock: Unveiling Finance-Tech Fusion

A GREEN AND SUSTAINABLE WAY TO FINANCE

Sustainability isn’t just about protecting the environment; it’s also about making sure that things will be profitable in the long run. Fintech is at the forefront of combining the success of business with the health of the planet.

What Fintech Can Do to Encourage Sustainable Investments

Changes in fintech are helping to make the funding world more sustainable by giving people and businesses the tools they need to research and invest in green and sustainable markets.

FTSE One Hundred’s Promise to Support Sustainable Finance

The FTSE 100 FintechZoom is committed to sustainable finance, and fintech is a key part of this business. Green finance projects have been added to the FTSE 100 FintechZoom, which shows that the company understands how important this style is.

MONEY TRANSFERS AND PAYMENTS ACROSS BORDERS

Because finance is global, green flow-border rate solutions are needed. With fintech in charge, fees are going down and prices are going up for these kinds of transactions.

How to Get Around Problems in Cross-Border Deals

Cross-border bills have been slow and expensive in the past. Fintech solutions are taking on these annoying problems head-on, making it incredibly easy for businesses and people to switch rate ranges.

New ideas through FTSE 100 When sending money abroad

FTSE 100 FintechZoom companies are coming up with new ways to make international payments and are using modern technology to make things easier and help with international trade.

TOOLS FOR MANAGING YOUR OWN MONEY

In this age of too many records, it can be hard to keep track of your own money. Fintech is responding with a set of tools that make the system easier to use, and the FTSE 100 FintechZoom is a big part of making these tools and getting them out there.

The Rise Of Personal Finance Tools Powered By Fintech

People can take control of their money lives with the help of fintech tools like budgeting apps and money trackers. These tools have become important parts of the services that FTSE 100 FintechZoom companies offer.

How FTSE 100 companies are helping people learn about money

This guide from the FTSE 100 on how to improve personal finance management tools shows a larger trend toward teaching people about money and giving them more power.

FORTUNE 500 COMPANIES AND FINTECH STARTUPS TO WORK TOGETHER

Innovative startups and established groups can get a lot out of working together. The FTSE 100 FintechZoom sees the value in these kinds of partnerships and is actively looking for them.

The Advantages of Working Together

Businesses offer fun and resources, while startups often bring flexibility and fresh ideas. When these trends come together, they make disruptive innovation possible in a big way.

Read More: FintechZoom Costco Stock Analysis and Insights

Stories of Collaboration That Worked

Startups and FTSE 100 FintechZoom companies have worked together to make some fintech achievements. These partnerships have not only led to growth but have also led to the creation of ground-breaking solutions.

INCLUSION AND ACCESS TO FINANCIAL SERVICES

Fintech can help connect people who don’t have access to traditional financial services with those who do. The FTSE 100’s projects show that the sector is committed to being open and accessible to everyone.

What Fintech Can Do to Help Include Everyone

Fintech isn’t really about using cutting-edge technology; it’s about using that technology to give people who haven’t had access to them before more financial services, giving them opportunities and power.

Programs aimed at underserved markets

FTSE 100 FintechZoom companies are leading projects that are making a real difference in people’s lives and the lives of communities. These projects range from microfinance solutions to mobile banking in remote areas.

What will happen to cryptocurrencies in the FTSE 100 in the future?

The FTSE 100 FintechZoom is keeping a close eye on this area as the role of cryptocurrencies in the global economy is still being figured out. Some businesses are already investing in or accepting digital currencies, so there is a real chance that more will do so.

FTSE 100 Companies and the Use of Cryptocurrencies

Some FTSE 100 FintechZoom companies are now using cryptocurrencies, which is a big step forward and changes the way people think about virtual assets from speculation to strategy.

Read More: FintechZoom Rolex Submariner-A Dive into Luxury Timepieces

Regulatory Things to Think About and Problems

Cryptocurrencies are becoming more popular as a hobby, but regulatory uncertainty is still a huge problem. The FTSE 100 FintechZoom approach to this growing asset class could be shaped by a balance of new ideas and smart decisions.

IT’S HARD AND RISKY TO INNOVATE IN FINTECH

But even though fintech has a lot of potential, it can be hard to use sometimes. When FTSE 100 FintechZoom companies plan their fintech strategies, they need to think about a lot of things, such as cybersecurity, following the rules, and moral issues.

How to Get Around in the Fintech World

The speed with which fintech is changing can be both a benefit and a risk. FTSE 100 FintechZoom companies should carefully look at new technologies and developments to stay competitive while minimizing the risks to their abilities.

Ways to lower the risks that come with fintech

FTSE 100 FintechZoom agencies can be good leaders in the fintech field by putting money into strong cybersecurity measures, encouraging a culture of compliance, and doing thorough checks of capability risks.

IN THE END

Inside the FTSE 100, the fintech scene is dynamic and full of opportunities. Buyers and finance professionals need to keep up with trends and new ideas because they affect the future of finance. Keeping up with the fintech movement in the FTSE 100 not only gives you ideas about market opportunities but also shows you how important it is to be flexible and think ahead in a world that is changing quickly.

A lot of people have questions about finance technology (FAQs) and the FTSE 100.

1. What does the FTSE 100 mean?

The FTSE 100 FintechZoom is a list of the 100 largest companies on the London Stock Exchange. These companies come from a wide number of industries. It is often used as a measure of how healthy the UK’s stock market and economy are as a whole.

2. Why is fintech important in the economic industry?

Fintech, which is a mix of financial services and technology, changes the way traditional banks give services, how they charge fees, and how they run the economy. It brings new ideas, efficiency, and accessibility to the financial world.

3. How has fintech grown in the FTSE one hundred?

In the FTSE 100, fintech has gone from being a new field of technology to a standard set of services. Companies are actively using digital bills, blockchain, and AI to improve their products and customer reviews.

4. What is the possible effect of the blockchain era on finance?

The blockchain era makes financial deals decentralized and clear. This surely cuts down on fraud, speeds up processes, and makes economic data safer.

5. How are digital-only banks affecting the banking quarter?

Digital-only banks, also called neobanks, are changing the way banks work by offering mobile-first, flexible, and low-cost banking services. This makes it harder for traditional banks to come up with new ideas.

6. What role do Artificial Intelligence (AI) and Machine Learning (ML) play in finance?

AI and ML are essential for personalizing economic products and services, boosting customer service, finding scams, and automating funding strategies. This makes finance smarter and more effective.

7. What are Open Banking and APIs, and how are they changing the economic landscape?

Open Banking and APIs make it possible for businesses to share financial information as long as customers agree. This promotes innovation, strengthens competition, and helps the creation of new financial services.

8. How are cellular payments and digital wallets gaining ground within the FTSE one hundred?

Mobile bills and virtual wallets are used by almost everyone because they are convenient, safe, and quick. FTSE 100 companies have started to use them to meet customer needs and make transaction records look better.

9. Describe what Regtech is and describe how FTSE 100 businesses use it.

Regtech, which stands for “regulatory technology,” uses technology to make regulatory reporting and compliance better. This helps FTSE 100 companies handle regulatory issues more effectively and lower risks.

10. How is technology causing improvements in the coverage quarter (Insurtech)?

Technology is changing the insurance industry by automating the handling of claims, using data to make personalized rules, and getting customers more involved, all of which lead to more efficient and custom services.

11. What are robo-advisors, and the way are they changing the funding landscape?

Robo-advisors are automated money management systems that use algorithms to give financial help and keep an eye on portfolios. This makes investing easier, cheaper, and more in line with each person’s goals.

12. Why is cybersecurity crucial in fintech, and the way are FTSE 100 groups handling it?

Cybersecurity is important in fintech to keep sensitive financial data safe and keep clients happy. To protect themselves from cyber threats, FTSE 100 companies are spending money on new safety features and procedures.

13. What are Decentralized Finance (DeFi) tendencies, and the way are FTSE a hundred agencies studying them?

DeFi is a term for banking that is based on blockchain and doesn’t use traditional middlemen. Some FTSE 100 companies are looking into DeFi because it could make financial systems more open and easy to use.

14. How is fintech selling sustainable and inexperienced financial tasks?

Fintech is making sustainable finance possible by providing platforms for impact investment, making it easier to track carbon footprints, and offering green financial products that support environmental goals.

15. What are the obstacles and improvements in move-border bills and remittances?

High costs and long working times are some of the problems. New technologies like Bitcoin and digital currencies offer more environmentally friendly and cost-effective ways to pay at borders.

16. How are fintech options improving non-public finance management?

Fintech solutions offer full personal finance management tools, such as spending apps, money trackers, and economic planning platforms, which help people make better financial decisions.

17. What are the blessings of cooperation between fintech startups and FTSE 100 businesses?

Collaborations bring the speed, creativity, and new ideas of startups together with the knowledge, size, and resources of FTSE 100 companies. This leads to disruptive innovation in the economy.

18. How is fintech adding to financial inclusion and accessibility?

By providing virtual banking, microfinancing, and other fintech solutions, the arena is reaching groups that aren’t getting enough help, giving them access to financial services, and increasing financial involvement.

19. What is the fate of cryptocurrencies in the FTSE 100?

While it is still changing, the future for cryptocurrencies is for more people to use them as both a way to pay for things and a way to invest. This will happen because regulations will become clearer and the technology behind them will get better.

20. What demanding situations and dangers are linked to rapid fintech innovation?

Rapid innovation creates tough problems, like cybersecurity risks, following rules, and the need for constant technology change to make sure customers are happy and the market stays stable.

More Read: Successful Freelance Web Developer & types of web developers